AGEFI Luxembourg

24

Juillet / Août 2019

Fonds / Bourse

L

es gérants de fonds

d’Ethenea n’entrevoient

pas encore la fin du

cycle économique actuel,

bien que les indicateurs

avancés semblent indiquer

un ralentissement de la

croissance. Comment adap-

tent-ils leur gestion de

fonds ?

Ces derniers mois, les prévisions

de croissance mondiale pour 2019

ont été constamment revues à la

baisse. «Néanmoins, nous nous atten-

dons à une croissance modérée avec

une inflation basse», déclare

Michael Blümke

(cf. por-

trait), gérant de fonds

chez

Ethenea.

«C’est pourquoi

nous

estimons

que la possibilité

d’une

récession

mondiale en 2019

reste faible.»

Après tout, l’économie

mondiale en est encore à

un stade avancé du cycle économique, dont

la fin ne peut être planifiée avec précision. Les

évolutions et les risques suivants doivent être sui-

vis de près : une nouvelle escalade de la guerre

commerciale, une réaction tardive des banques

centrales avec un maintien prolongé de la poli-

tique monétaire accommodante et des risques

géopolitiques tels que la récente tension entre

l’Iran et les États-Unis.

Certes, après le rapprochement récent entre les

Etats-Unis et la Chine, les signes d’un accord à

court terme se sont quelque peu accentués.

Néanmoins, il serait optimiste d’espérer

une véritable avancée dans un futur

proche. Toutefois, compte tenu des

élections présidentielles américaines

l’année prochaine, nous supposons

que le président soit susceptible de

céder à la guerre commerciale et

que l’onpuisse s’attendre à ce que la

Fed prenne des mesures pour

contrebalancer les ajustements sus-

mentionnés. Jusqu’à ce qu’une

solution soit trouvée, nous croyons

qu’une nouvelle escalade de la

guerre commerciale demeure le

risque le plus probable.

En outre, dans l’éventualité d’un nou-

veau ralentissement de la croissan-

ce, et au vu des annonces

qu’elles ont déjà faites,

nous estimons qu’il

serait risqué pour

les banques cen-

trales de recourir avec

une prudence excessive à

leurs mesures de soutien

de la politiquemonétaire.

Préférence pour les

obligations d’entreprises

Volker Schmidt, gérant du fonds Ethna-DEFEN-

SIV, déclare qu’il existe encore des opportunités

intéressantes sur les marchés obligataires. «Les

obligations d’entreprise continuent d’offrir une

prime de rendement attractive par rapport aux

obligations d’État. Ceci est dû à une croissance

économique plus lente mais toujours positive, à

des conditions de refinancement favorables et

par conséquent, la perspective de faibles taux de

défaillance continue de rendre les investisse-

ments en obligations d’entreprise attrayants. Il

continue à mettre l’accent sur les obligations

d’entreprise de grande qualité, mais estime éga-

lement que les bons du Trésor américains offrent

de bonnes conditions: La faiblesse de l’offre, et les

risques associés audifférend commercial entre les

États-Unis et la Chine, rendent les investisse-

ments dans cette classe d’actifs très attractifs par

leur nature sûre et très liquide.»

Technologie, biens de

consommation cycliques, santé

Selon Harald Berres, gérant du fonds Ethna-

DYNAMISCH, les marchés boursiers sont tou-

jours dans l’attente : «C’est pourquoi nous inves-

tissons actuellement dans des secteurs et des

actions avec un profil plus défensif. Il privilégie

les entreprises dont les valorisations sont

attrayantes dans les secteurs de la technologie,

des biens de consommationnon cycliques et de la

santé. Leur croissance structurelle est générale-

ment relativement stable, ce qui est conforme à

notre stratégie d’investissement à long terme. En

Europe, la rentabilité et la croissance du chiffre

d’affaires des sociétés à grande capitalisation ont

été inférieures à celles de l’indice de référence au

cours des vingt dernières années et aucune amé-

lioration n’est à prévoir dans un avenir proche.

C’est pourquoi nous voyons plus de potentiel

dans les entreprises américaines». Au cours des

mois d’été, selon Harald Berres et ses collègues,

les marchés boursiers resteront relativement

faibles et volatils, ce qui pourrait entraîner une

baisse encore plusmarquée des actions cycliques.

Malgré tout, les actions resteront la classe d’actifs

la plus attractive à moyen terme.

Lesmétaux précieux atteignent

de nouveaux sommets records

«Dans le fonds Ethna-AKTIV, nous avons réduit

notre exposition aux actions et allongé les

échéances des obligations», déclare Michael

Blümke, gérant du fonds. «Nous l’avons fait pour

contrer la volatilité des marchés boursiers et pour

continuer à profiter de la baisse des taux d’intérêt

américains que nous envisageons dans notre scé-

nario de référence. Cette allocation, qui représente

près de 80%du portefeuille, restera au cœur de ce

dernier. Comme nous croyons toujours que lapro-

babilité d’une récession au cours des 12 prochains

mois est faible, nous souhaitons maintenir ce bas

niveau d’exposition seulement à court terme. Dès

que la volatilité diminuera, nous augmenterons à

nouveau notre exposition aux actions. Dès que

l’incertitude entourant la guerre commerciale

s’atténuera, nous prévoyons d’augmenter à nou-

veau l’exposition aux actions.»

«Nous pensons que l’allocation en or d’Ethna-

AKTIV deviendra de plus en plus importante et

attrayante en raison des faibles taux d’intérêt

réels», déclare Michael Blümke. «Après des

années de consolidation latérale et une politique

de taux d’intérêt de plus en plus accommodante,

ce n’était qu’une question de temps avant que le

prix dumétal précieux n’éclate et, à notre avis, une

hausse des prix vers de nouveaux sommets histo-

riques est plus que probable à long terme.»

Sur le marché des devises, l’appréciation du billet

vert par rapport à l’euroaucoursdes sixprochains

mois est le scénario le plus probable pour Michael

Blümke. «Nous nous attendons à ce que les Etats-

Unis continuent de croîtreplusviteque l’Europe et

que les problèmes non résolus de l’Europe conti-

nuent de peser sur le cours de la devise. Par consé-

quent, nous avons un positionnement surpondéré

endollar américain par rapport aux autres devises

détenues dans Ethna-AKTIV.Après avoir tiré pro-

fit de la forte baisse des taux d’intérêt au cours des

neuf derniersmois, non seulement au seindupor-

tefeuille obligataire, mais aussi par le biais d’ajus-

tement de la duration du portefeuille (duration

overlay), nous récupérons les bénéfices générés

par l’overlay et restons neutres pour l’instant.

Toutefois, à long terme, nous nous attendons à ce

que les taux d’intérêt continuent de baisser.»

La fin du cycle économique n’est pas encore en vue

Par Adrien PICHOUD, chef économiste

et Head Multi-Asset chez SYZ Asset

Management

L

a croissancemondiale est

confrontée à deux risques

géopolitiquesmajeurs. La

guerre commerciale sino-américai-

ne et lamontée du populisme en

Europe ont engendré une nouvel-

le ère de sensibilité dumarché.

Mais au-delà des fluctuations à

court terme, ces événements ont-

ils un impact significatif sur la

croissance?

Audébutdel’année,laChineetl’Europe

onttoutesdeuxaffichédessignestimides

de stabilisation, mais les chiffres les plus

récentsnesontpasparvenusàconfirmer

la reprise de l’activité escomptée. Même

si cela peut sembler lié aux événements

macro-économiques, les investisseurs

doivent distinguer l’impact des évolu-

tions politiques sur la volatilité du mar-

ché de leur impact sur la croissance, afin

de comprendre les implications en

termes d’allocationd’actifs.

Un changement structurel

La guerre commerciale entre les Etats-

Unis et la Chine a changé la donne. Elle

aremisenquestionl’ordreétablidesrela-

tions commerciales et ouvert une «Boîte

dePandore»desrenégociationsdontl’is-

sue laplus encourageante serait que l’on

ne revienne pas à unordremondialisé.

Cechangementstructurelaprovoquéun

nouveau paradigme de regain de sensi-

bilité du marché. En outre, l’escalade

récente des tensions sino-américaines a

accru les risques de détérioration et

ajouté des incertitudes aux perspectives

de croissance. Même si nous sommes

convaincus que la rationalité finira par

l’emporter,lerisqueextrêmeaégalement

progressé, et l’orgueil national devrait

par conséquent devenir le moteur prin-

cipal des processus de négociations.

En Europe, lamontée du populisme est

omniprésente,commeentémoignentles

dernières élections au Parlement

Européen et la longue saga du Brexit.

Toutefois,au-delàdel’impactsurlavola-

tilité à court terme, seuls deux facteurs

importent pour les marchés. Le risque

d’éclatementdelazoneeuroconstituela

plus grande menace, suivi par le risque

que le consensus politique puisse

conduire un pays à quitter le cadre de

Maastricht caractérisé par un déficit

budgétaire et unedettepublique faibles.

Mêmel’Italie,quisuscitedesinquiétudes

perpétuelles chez les investisseurs, pré-

sente des risques minimes à ces deux

égards. Si un nouveau gouvernement

formé par la Ligue et le centre-droit arri-

vait aupouvoir, laprobabilité qu’il igno-

recomplètementlecadreeuropéenserait

relativement faible. L’Italie a toujours le

soutien de la BCE et le discours de

MatteoSalvinitientdavantagedelapos-

ture médiatique que de la réalité. Par

conséquent, nous ne sommes pas trop

préoccupés par l’impact des évolutions

politiques ponctuelles en Europe sur la

croissance.

Notre scénario de référence reste celui

d’une croissancemondiale ralentiemais

positive, qui rappelle la situation au

Japon. La situation pourrait se dégrader

avantdes’améliorer,etfinalementsesta-

biliseràunniveaumoinsoptimal,dufait

du bouleversement dans les relations

commerciales mondiales. Toutefois,

aucune récession, ni faiblessede la crois-

sance ou de l’inflation ne sont entrete-

nues par les politiques accommodantes

des banques centrales, ni par la forte

demande intérieure dans lemonde.

Rester dynamique

Dans l’expectative d’un équilibre mar-

qué par une croissance plus faible, nous

avons pris des mesures pour protéger

nos stratégies multi-actifs. Dans le

contexte actuel, les actifs traditionnelle-

mentdéfensifs,telsquel’or,sontonéreux.

Ainsi, au lieu d’accroître l’exposition à

ces valeurs refuges, nous cherchons une

protectionenréduisantlesavoirsactuels

en actifs risqués. Nous avons opté pour

unallégementdesactions,plussensibles

aux actualités négatives et à la morosité

que les autres classes d’actifs et qui vont

faire les frais du regainde volatilité.

Nous nous abstenons également de

prendre un risque de duration sur les

obligations du Trésor américain, essen-

tiellement pour des raisons de valorisa-

tion. Puisque, selon nous, une récession

est improbable, la chute récente des ren-

dements à long terme a sans doute été

excessive et dans tous les cas, offre peu

d’intérêtparrapportauportageprésenté

parlesobligationsàcourtterme.Eneffet,

en restant investi sur le segment des

échéances courtes de la courbe via les

bons du Trésor américain à un an, nous

pouvons obtenir 2% de rendement

garanti sur un investissement extrême-

ment liquide, sans encourir le risque de

perte de capital.

Dans le reste du monde, les politiques

monétaires accommodantes ont dissipé

les craintes concernant la liquidité qui

tourmentaient les investisseurs au 4ème

trimestre 2018, favorisant les actifs obli-

gataires plus risqués. Par conséquent,

pour générer des rendements dans ce

contexte de croissance morose, nous

recherchons le portage sur les segments

obligataires plus risqués. La dette en

devises fortes des marchés émergents

nous paraît avantageuse, grâce aux

spreads attractifs et à la stabilité des

devisespourl’instant.Ensupposantune

faible croissance conjuguée à une pour-

suitedespolitiquesaccommodantessans

l’ombre d’une récessiondans les 12 pro-

chains mois, aucun obstacle visible ne

devraitvenirmenacerlesmarchésémer-

gents. La liquidité est abondante, les

devises locales ne seront pas dévaluées

par undollar raffermi, et les défaillances

resteront limitées.

Nous privilégions une expositiondiver-

sifiéeàl’universdesmarchésémergents,

notamment les pays moins exposés au

risquemacro-économique,enévitantles

économiesduSud-Estasiatiqueliéesàla

Chine, et exempts de faiblesses particu-

lières. Les pays d’Amérique latine, tels

queleBrésil,etlespaysd’Europedel’Est

caractérisés par des obligations libellées

eneuroetunrendementattractif,telsque

la Pologne et la Roumanie, sont les plus

intéressants.

Lesobligationsfinancièressubordonnées

européennes affichant des bilans solides

présentent également unportage attrac-

tif à des valorisations abordables, soute-

nues par des politiques monétaires

accommodantesquidevraientempêcher

un nouvel élargissement des spreads.

Néanmoins, nous abordons cette classe

d’actifs aucaspar cas afindedéterminer

des profils risque/rendement positifs.

Puisqu’à notre avis, aucune récession

n’estimminente,nousévitonslesvaleurs

refuges onéreuses et conservons une

flexibilité dans notre allocation d’actifs.

En restant réactifs et en ajustant les allo-

cations d’actifs en vue de refléter les

changementsdeparadigmesquesont le

regain de volatilité et la stagnation de la

croissance,nousparvenonsàdécelerdes

opportunités dans lemarasme actuel.

Est-il temps de se positionner en vue d’une débâcle économique mondiale?

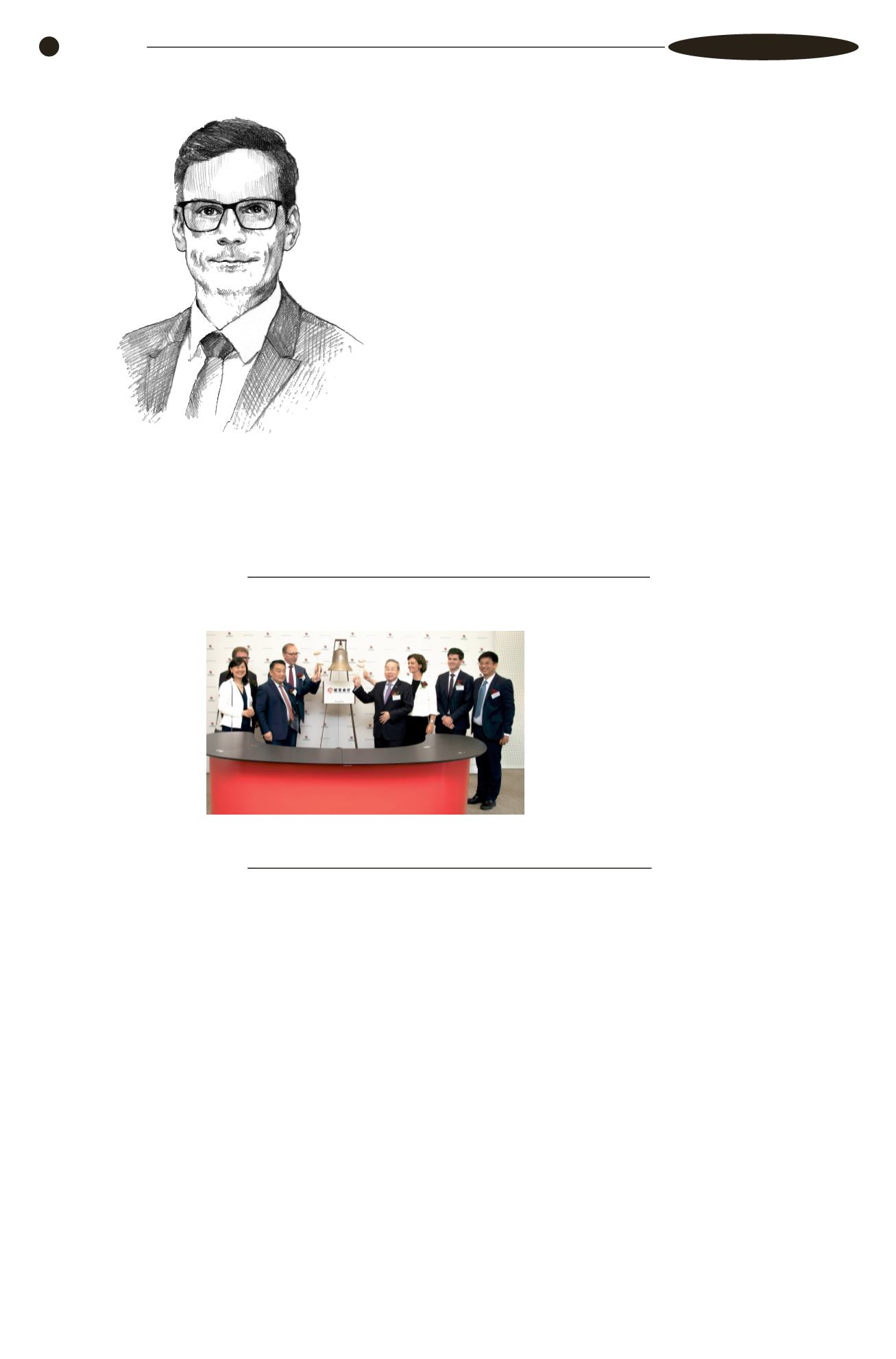

T

he Luxembourg Stock

Exchange todaymarked

ChinaMerchants Bank’s

first bond listing in Luxembourg

since 1997. The

€

300 million bond

is the Chinese bank’s first-ever

listed Euro-denominated bond.

The Ring the Bell ceremony took

place at the Luxembourg Stock

Exchange in the presence of H.E.

Mr Huang Changqing, the

Chinese Ambassador to

Luxembourg, on 20 June.

“Wewelcome this new listing byChina

Merchants Bank. It is an excellent illus-

tration of the increased scope of coope-

ration and activity between Chinese

banks and European capital markets,

andwe are proud to be part of this new

chapter,” commented Robert Scharfe,

CEO of the Luxembourg Stock

Exchange. The 3-year fixed-rate bond is

issued under China Merchants Bank’s

US$5 billion Medium Term Note

Programme, andwas listed on LuxSE’s

EuroMTFmarket.

“This new bond issuance speaks of

our global ambitions. In the future,

green and sustainable assets financing

and the Belt and Road Initiative are

going to be the fields that we will

continuously expand and develop.

Given Luxembourg’s leading position

at the intersection between Chinese

and European capital markets, the

Luxembourg Stock Exchange was a

natural choice,” statedBiao Li, CEOof

ChinaMerchants Bank’s Luxembourg

branch.

In 2016, the Luxembourg Stock

Exchange and China Merchants Bank

signed a Memorandum of Understan-

ding andagreed to cooperate on listing

and trading activities of securities

issued by China Merchants Bank and

its clients.

Exponential growth

ChinaMerchants Bankwas established

in 1987 in Shenzhen and is China’s first

joint-stock commercial bank wholly

owned by corporate legal entities. Since

its inception, CMBhas grown exponen-

tially and now counts more than 1,200

branches and approximately 70,000

employees.

China Merchants Bank Luxembourg

Branchwasestablishedin2015,andacts

as the bank’s Europeanheadquarters. It

provides a range of financial products

and services to corporate and private

customers across Europe and inChina.

LuxSE rings the bell for China Merchants Bank